Probate Cash Advance

Purchasing a property is most likely the biggest financial decision you will ever make. Whether this is your first purchase or you are an experienced buyer, this decision must be made carefully

Getting Your Probate Cash Advance

Probate Cash Advances Vs. Probate Loans

The Realty Stylist offers probate cash advances to heirs such as yourself whose money is trapped in the lengthy probate court process. Our cash advances are not loans, providing several advantages to you. Unlike traditional lenders and banks, we never charge an interest rate, there are no monthly payments, and there’s no need to risk losing collateral assets such as your car or home. Your employment history and credit score won’t impact your eligibility either.

In order to qualify for probate funding, all we ask is that you’re an heir to an estate currently going through probate and that you will be receiving at least $17,000 when the estate closes. As long as that’s the case, we can usually send you a portion of your inheritance right away. In return, you assign a set dollar amount to our company and we wait for the probate estate to close. We even offer significant rebates if we are paid back earlier than originally planned.

Fast And Easy Cash From Probate

When applying for a probate cash advance, you can expect to receive funds in as little as three days. Your dedicated Funding Officer will work closely with you and your attorney and be available by phone and email throughout the entire process.

Understanding The Probate Process

What Is Probate?

Simply put, probate is a court-supervised process that oversees the transfer of an individual’s assets (i.e. their “estate”) after death. Probate is a complex, tedious, and time-consuming process that is riddled with delays. Heirs almost always underestimate the amount of time it will take for them to receive their inheritance from an estate in probate. On top of the delays, there is often lack of clarity on how the process works.

As an heir, here are some facts that you should immediately understand regarding your role in the probate and inheritance process:

- Contrary to popular belief, the attorney handling the probate estate represents only the personal representative (PR) of the estate. This person may also be referred to as the Executor, Executrix or Administrator of estate. All other heirs to the estate are NOT represented by the estate attorney. Because of this, the attorney is under no obligation to take or return any phone calls, provide general information or legal advice to heirs other than the PR.

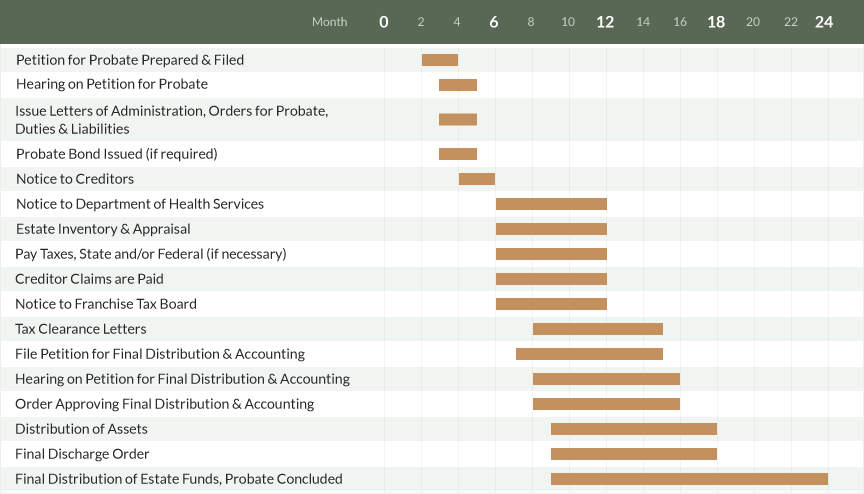

- The probate process goes through a number of drawn out steps in most cases before distributing a penny to the rightful heirs. Every estate is different but the following chart gives you a sense of the complexity and drawn out timeframe.

How Does The Probate Process Work?

Once again, all estates go through the probate process slightly differently. This breakdown is meant to showcase a fairly “regular” probate procedure.

The very first step in the probate process is to file the petition for probate. This petition, along with the original will and codicils (legal alterations to the will) are filed with the probate court. The Notice of Petition to Administer Estate is also filed during this stage. In this case, the “petitioner” is usually the proposed personal representative.

Once these forms have been filed, the court clerk will set a hearing for 45-60 days after the filing date. It is at this point that notice has to be given to all of the people named in the will. This is the stage at which you will first receive notice of your inheritance. The Notice of Petition to Administer Estate is also published in a local newspaper to alert the decedent’s creditors. It is during this time that they must file their claims with the court.

At the hearing, if no one has filed an objection to the probate, the court will admit the will to probate and appoint the PR. After this appointment, the court will issue Letters Testamentary or Letters of Administration which are used by the PR to prove that they have the authority to act on behalf of the estate.

The second step in the probate process consists of an ongoing process of filings, notifications and applicable settlements. The following is just a short list of tasks which must be completed:

- Identify all of the assets owned by the decedent at the time of death.

- File an Inventory & Appraisal which values the estate’s assets, both real (land) and personal.

- Notify the Department of Health Services.

- Liquidate all of the estate’s assets.

- Pay any debts, claims or taxes that are due and object to claims which should not be allowed.

- Settle all financial and property disputes.

The final step in the probate process consists of closing the estate and distributing the remaining assets to the heirs. If all goes smoothly, the final actions in the probate will be as follows:

- Obtain a court order of distribution.

- Close the estate accounts.

- Make final distributions to the heirs.

- Obtain receipts from the heirs for the distributions made to them.

As you can tell, the probate process is indeed a long and difficult process. The good news is that the personal representative chose to retain a probate attorney to guide the estate through this complicated process. The bad news is that, even with the help of an attorney, the probate process can still take 12-18 months and in many cases even longer.

Can I Access My Money Today?

While some estates can be administered in 18 months or less, a large percentage of estates can take up to 3 years to close. This means that the estate heirs may not receive any inheritance money for up to 3 years after probate first begins.

If you would like to access your inheritance money right away, we can help you get money in as little as 3 days. We provide cash advances to heirs who have an inheritance stuck in probate. If you are interested in learning more about our cash advance and probate funding process, please fill out the form below for a free, no pressure consultation with one of our friendly Funding Officers.